Cargo Vessel Market Evaluation, Review, Landscape, Estimates, Prospects, Growth and Trends, 2030

- Rishika Chavan

- Sep 22, 2025

- 3 min read

According to Fortune Business Insights™, the global cargo vessel market is undergoing significant transformation as maritime trade continues to drive global commerce. According to Fortune Business Insights™, the market was valued at USD 37.07 billion in 2022 and is expected to expand from USD 49.22 billion in 2023 to USD 61.77 billion by 2030, growing at a CAGR of 3.3% during the forecast period.

Why Cargo Vessels Matter

Cargo vessels form the backbone of international trade, transporting goods, raw materials, and industrial supplies across continents. With increasing globalization, shipping remains the most cost-effective mode of transport, supporting industries such as automotive, oil & gas, food & beverages, and consumer goods.

Key Market Insights

Asia Pacific dominance: The region held a commanding 60.53% market share in 2022, led by China, Japan, and South Korea, the world’s shipbuilding giants.

Tanker vessels lead: Tankers accounted for the largest share, fueled by strong demand for oil and chemical transport.

Fuel shift underway: Diesel and gasoline remain dominant, but LNG and hybrid-powered ships are gaining traction as decarbonization becomes a top priority.

Market Trends to Watch

Green Shipping FuelsWith shipping responsible for nearly 13% of global SOx and 15% of global NOx emissions, companies are rapidly adopting LNG, methanol, hydrogen, and LPG as cleaner alternatives. Industry leaders like MOL Group are investing heavily in LNG-powered vessels as part of their 2050 zero-emissions vision.

Air Lubrication TechnologyInnovative energy efficiency solutions, such as air lubrication systems, are reducing resistance between hulls and seawater. Companies like Alfa Laval, Mitsubishi Heavy Industries, and Wärtsilä are actively deploying these systems, helping shipping lines cut fuel costs and carbon emissions.

Information Source:

Market Segmentation

By Ship Type

Tanker: Largest share in 2022, driven by oil and chemical transport demand.

Bulk Carriers: Fastest-growing segment; used for transporting coal, grains, cement, and ore.

Container Ships, General Cargo, Roll-on/Roll-off, Others: Growing demand across industries.

By Fuel Type

Diesel & Gasoline: Largest share in 2022, driven by decarbonization initiatives.

LNG: Fastest-growing segment, supporting emission reduction and regulatory compliance.

Hybrid & Other fuels: Gradual adoption to reduce environmental impact.

By Gross Tonnage

Below 50,000 GT: Largest segment due to widespread industrial demand.

50,000 – 120,000 GT: Fastest-growing segment for medium-scale cargo transport.

Above 120,000 GT: Niche segment with a 16.09% market share in 2022.

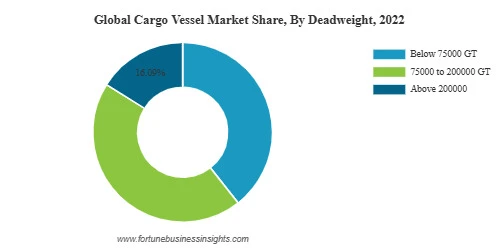

By Deadweight

75,000 – 200,000 DWT: Largest and fastest-growing segment; includes medium and large container ships, tankers, and bulk carriers.

Below 75,000 DWT: Second fastest-growing; includes smaller cargo vessels for niche requirements.

Above 200,000 DWT: Specialized large vessels, limited market share.

Regional Outlook

Asia Pacific: Expected to remain the largest and fastest-growing market due to high maritime trade volumes and advanced shipbuilding infrastructure.

Europe: Strong focus on fuel-efficient and eco-friendly vessels, with innovation from companies like Damen Shipyards.

North America: Growth driven by fleet modernization and U.S. government investments in maritime infrastructure.

Middle East & Africa: Steady growth as trade routes expand and global shipping demand rises.

Latin America: Increasing role in supply chain logistics, particularly for food and medical supplies.

Key Players

Prominent companies include:

Hyundai Heavy Industries Co. Ltd. (South Korea)

Samsung Heavy Industries (South Korea)

Daewoo Shipbuilding & Marine Engineering (South Korea)

China State Shipbuilding Corporation (China)

Mitsubishi Heavy Industries (Japan)

General Dynamics NASSCO (U.S.)

Damen Shipyards (Netherlands)

Industry Developments

June 2023 – Tersan Shipyard secured contracts for construction service vessels for Acta Marine.

June 2023 – Udupi Cochin Shipyard bagged a USD 72 million order for six next-generation cargo vessels for Wilson Shipowning AS.

Outlook & Opportunities

Despite cyclical challenges and cost pressures in shipbuilding, the push for decarbonization, digitalization, and green fuel adoption positions the cargo vessel market for steady long-term growth. Rising maritime trade volumes, technological upgrades, and sustainability mandates are expected to reshape the industry landscape by 2030.

Comments